Be ready to make the most of your benefits in 2023

The health system offers robust benefits to support you and your family. By investing a little time to get organized now, you’ll reap the benefits all year long – and beyond.

Understanding Deductibles, Copays and Coinsurance

Deductibles, copays and coinsurance – oh my!

Let’s be honest. The lingo around health insurance is confusing to most people. But, it’s important to understand some key terms so you can choose the medical plan that works best for you and make the most of your coverage during the year.

Spend a few minutes reading this article. Before you dig in, know which health plan you signed up for (HSA Advantage Plan or Signature Plan). You may want to open a second tab and keep the summary of medical plans open so you can refer back to it as you learn about these terms.

The basics

When you are enrolled in one of our medical plans, you and the health system share the cost for your healthcare expenses. The health system has engaged Blue Cross and Blue Shield to administer our health plans. Prescription coverage is provided as part of both plans with Navitus Health Solutions as the administrator.

Deductibles, coinsurance and copays are examples of what you pay for your share of costs.

What is a deductible?

A deductible is the amount you pay for the cost of healthcare services and prescriptions before the health system begins to pay its share.

How it works: If your deductible is $1,500, you’ll pay 100% of eligible healthcare expenses until what you’ve paid adds up to $1,500. After that, you “met your deductible” and you share the cost with the health system by paying coinsurance for covered services and prescriptions.

You can read more about deductibles below.

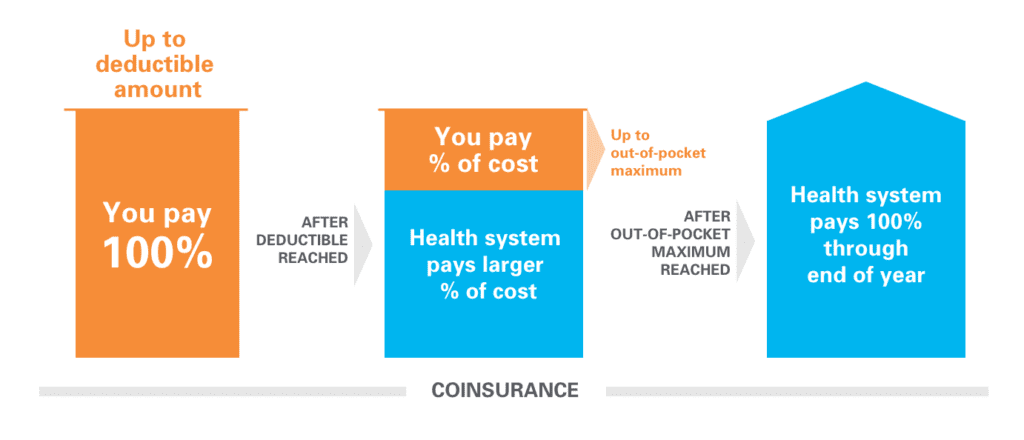

What is coinsurance?

Coinsurance is your share of the cost of a covered healthcare service or prescription after you’ve met your deductible. It’s usually figured as a percentage of the amount allowed to be charged for services.

How it works: You’ve paid $1,500 in healthcare expenses and met your deductible. Now when you go to the doctor, instead of paying the full cost, you and the health system share the cost. For example, if you go to a health system emergency room, the health system pays 90%. The 10% you pay is your coinsurance.

What is a copay?

A copay is a fixed amount you pay for a covered healthcare service or prescription, usually when you receive the service. The copay amount is different depending on the type of service/prescription and which provider network/pharmacy you use. Copays do not count toward your deductible—you always pay that amount whether you have met your deductible or not.

How it works: You see a health system specialist several times a year. At each visit, you will pay a $40 copay even if you have met your deductible for the year.

How each plan works

The HSA Advantage Plan uses coinsurance for all covered services and prescriptions

The Signature Plan uses copays for in-network office visits and prescriptions, and uses coinsurance for some services after your deductible is met. Note: Copays do not count toward your deductible.

What is the out-of-pocket maximum?

This is the most you’ll ever have to pay for covered services in the calendar year. After you’ve paid this amount, you’ll have no copays or coinsurance—the health system will pay 100% of the cost of all covered services and prescriptions for the rest of the calendar year.

Important fact about preventative care

The health system wants all employees and their families to get the right healthcare services to he well-even if you are already healthy. That’s why the health system pays 100% for preventative care in both plans when you use in-network providers. That means no deductible to meet and no copay or coinsurance for these services. So, don’t delay-keep up with your annual physicals and preventive screening exams.

Resources

Medical coverage:

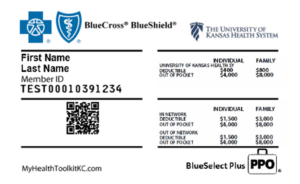

- Your Blue Cross ID card lists your deductible and out-of-pocket maximum.

- Log in to your health plan account with Blue Cross and Blue Shield (BCBS) or register at com. There you’ll find more tools to understand your medical benefits, find in-network providers and more.

- Use the Blue Cross mobile app to see your plan’s copay/coinsurance amounts. Download My Health Toolkit® for BCBS from your app store.

- Pharmacy coverage:

- Log in or create an account at Navitus.com or in the Navitus mobile app. You’ll have access to a digital ID card, your medication history (starting with Jan. 1 when Navitus became our pharmacy benefit administrator) and more.

- Read more about how to make the most of your pharmacy benefits in several articles in Use Your Benefits.

All benefits:

- Bookmark and continue to visit the Benefits Connection website at https://kansashealthsystembenefits.com for benefits information and tips for making the most of your benefits year-round. No password or network access is needed.

More about deductibles

- The phrase “meet your deductible” means paying that amount before the health system begins to pay. After you meet your deductible, your share of cost is coinsurance.

- Your deductible resets to zero on Jan. 1 each year.

- The Signature Plan has an embedded deductible.

- Once any covered member in your family meets their individual deductible, the health system begins to pay its share for that person’s covered services, even if the family deductible has not been met.

- Example: John has employee + spouse coverage and uses health system providers. They each have an annual deductible of $400.

- John has met his deductible of $400. The health system will now pay a portion of his medical expenses for the rest of this year.

- John’s wife Laurie hasn’t had any medical expenses yet this year but went to the emergency room this week. She’ll need to pay the first $400 of the cost since her individual deductible had not been met. Going forward, the health system will pay a portion of qualified expenses for the rest of the year.

- John and Laurie will continue to pay copays for in-network office visits and prescriptions.

- The HSA Advantage Plan has an aggregate deductible.

- The full amount of the family deductible must be met before the health system begins to pay for anyone’s services.

- Example: Steve has employee + spouse coverage and uses health system providers. The family deductible is $3,000.

- In January, Steve went to urgent care, filled prescriptions and had several follow-up doctor’s appointments. His medical bills so far total $1,250.

- Steve’s wife Sarah injured her ankle and had several physical therapy sessions, filled prescriptions and visited her specialist. Her medical bills so far total $2,300.

- Together, Steve and Sarah have met their family deductible and the health system will pay a portion of their qualified expenses for the rest of this year.

- Steve and Sarah used the $1,000 in seed money the health system put in their HSA to pay part of their cost.

Get support

The Benefits team is here to help you make the most of your benefits. Please call 888-494-9119 with any questions. The phone line is open Monday-Friday, 8 a.m.-5 p.m. CST and there is a Spanish option available. You may also email BenefitsConnection@kumc.edu.

Top 6 apps to have on your phone

This year, resolve to keep your health system benefits at your fingertips. Download these helpful apps to your phone so you can easily get to tools for your physical, mental, financial and holistic health.

All the apps are free in the App Store and Google Play – simply search by the name of the app as listed below. We’ve included the icons so you can easily select the right one.

Pro tip: Once you’ve downloaded them, create a folder on your phone’s home screen to keep them together. Give the folder a descriptive name (My Benefits) so you have these helpful apps at your fingertips year-round.

1. Medical Coverage

For employees who signed up for a medical plan in 2023

Use your digital ID card, find in-network providers, check the status of claims and more.

- Download: My Health Toolkit for BCBS mobile app

- Get started: Click “Get Started” and create an account with your member ID number (or your Social Security Number) and your date of birth.

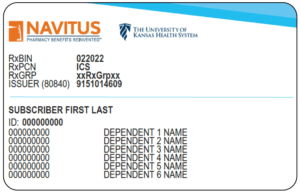

2. Pharmacy Coverage

For employees who signed up for a medical plan in 2023

Use your digital ID card, see your medications and more

- Download: Navitus mobile app

- Get started: Click “Sign Up” and enter information on the ID card sent to your home.

3. Retirement and pretax savings accounts

For all benefits-eligible employees

Keep track of your retirement savings, check your HSA or FSA balance (if applicable), get free tools to support your financial health and more.

- Download: NetBenefits mobile app. Read more about Fidelity’s app.

- Get started: Create an account by clicking “Register as a new user” at the bottom of the first screen. Then enter the information requested including the last 4 digits of your Social Security number.

4. Mental health support

For all employees regardless of benefits eligibility

24/7 access to free counseling and other tools from ComPsych to support mental and emotional health for you and your family members through our Employee Assistance Program (EAP). All services and tools are 100% confidential.

- Download: GuidanceNow mobile app

- Get started: Click Register at the bottom of the first screen. Create an account by entering organization web ID: health system.

If you or a family member are in crisis, call for immediate help: 855-784-2052 or TTY: 800-697-0353.

5. Tools for holistic health

For all employees regardless of benefits eligibility

Free wellness tools to help you with everything from workouts to cooking demonstration videos with our It’s About You wellness program.

- Download: Navigate Wellbeing mobile app

- Get started: Create an account at KansasHealthSystemWellness.com. Click Join Now > enter the requested information including your employee ID number (in your Workday profile or on the back of your badge). The enter your account information into the app.

6. Shopping discounts

For all employees regardless of benefits eligibility

Save money with Perks For You on events, travel, products, services and local businesses.

- Download: BenefitHub mobile app

- Get started: Create an account by enter your work email address and clicking “Get ” Answer “no” to the question about having a referral code. Type TUKHS in the “Your organization name” field, then click “Validate.” Then enter your employee ID number (in your Workday profile or on the back of your badge) and other information as requested.

ID Cards

New benefits-related ID cards

If you signed up for medical, dental or vision coverage for 2023 and/or enrolled in a healthcare Flexible Savings Account or Healthcare Savings Account, this is for you!

Medical plan ID cards

Employees who signed up the HSA Advantage Plan or the Signature Plan for 2023 will receive two identification cards to let providers know about your health coverage for next year. Once card is from Blue Cross and Blue Shield for medical plan coverage; the other card is from Navitus solutions for prescription drug coverage.

Use new ID cards starting Jan. 1

Both ID cards should arrive by U.S. mail at your home address by the end of the calendar year. Share these new cards with your providers when receiving services on or after Jan. 1, 2023. Until then please continue to use the identification card for your current plan.

Blue Cross Blue Shield

Use for all healthcare services

(doctors, emergency rooms, etc.)

Navitus Health Solutions*

Use for prescriptions

* The health system pharmacy already has the information needed from Navitus. You and your covered dependents do not need to provide the Navitus card or any Navitus information when filling prescriptions from a health system pharmacy – whether for home delivery or pick up.

Delta Dental ID cards

Employees who signed up for dental coverage for 2023 will receive an identification card from Delta Dental in the U.S. mail ONLY if you are new to the plan. If you have coverage in 2022, please continue to use your current card in 2023.

Vision coverage ID cards

VSP does not send out identification cards for vision coverage. Instead, covered members provide their Social Security number during their visit; the provider will be able to access your coverage in their system.

If you have questions, please contact the Benefits team at BenefitsConnection@kumc.edu.

Pretax Savings Accounts (HSA, FSA)

Accessing HSA funds

Employees who signed up for the HSA Advantage medical plan should keep in mind the following considerations for accessing funds from their Health Savings Account (HSA).

- The full amount of seed money from the health system will be available in your HSA by Jan. 7, 2023 ($500 for employee-only coverage and $1,000 for employee + any family coverage).

- HSA debit cards were mailed to employee homes from Fidelity.

- Funds from your per-paycheck contributions must be fully posted to the HSA account before you can access them. This will usually be the Monday after each pay date (when no bank holidays).

It’s easy to check your HSA balance at NetBenefits.com/AtWork or on the mobile app by Fidelity. Log in (or, if you’re new, create an account) to confirm funds are available, check account statements, name beneficiaries and more. For questions, please call Fidelity at 800-343-0860.

For general benefits questions, please email BenefitsConnection@kumc.edu.