Click here to see information about 2025 benefits

Let’s be honest. The lingo around health insurance is confusing to most people. But, it’s important to understand some key terms so you can choose the medical plan that works best for you and makes the most of your coverage during the year.

Spend a few minutes reading this article. Before you dig in, know which health plan you signed up for (HSA Advantage Plan or Signature Plan). You may want to open a second tab and keep the summary of medical plans open so you can refer back to it as you learn about these terms.

When you are enrolled in one of our medical plans, you and the health system share the cost for your healthcare expenses. The health system has engaged Luminare Health to administer our health plans. Prescription coverage is provided as part of both plans with Capital Rx as the administrator.

The HSA Advantage Plan uses coinsurance for all covered services and most prescriptions.

The Signature Plan uses primarily copays for health system and in-network office visits and prescriptions; it uses coinsurance for some services after your deductible is met. Note: Copays do not count toward your deductible.

The health system wants all employees and their families to get the right healthcare services to be well – even if you are already healthy. That’s why the health system pays 100% for preventive care in both plans when you use health system or in-network providers.

That means no deductible to meet and no copay or coinsurance for preventive services. So, don’t delay – keep up with your annual physicals and preventive screening exams.

A deductible is the amount you pay for the cost of healthcare services and prescriptions you receive before the health system begins to pay its share. Your deductible amount varies based on three factors:

How it works: If your deductible is $1,800, you’ll pay 100% of eligible healthcare expenses for care and prescriptions until what you’ve paid adds up to $1,800. After that, you have “met your deductible” and you share the cost with the health system by paying coinsurance for covered services and prescriptions for the rest of the calendar year.

Each medical plan has a different type of deductible. Read about the Signature Plan’s embedded deductible and the HSA Advantage Plan’s aggregate deductible to understand how they work.

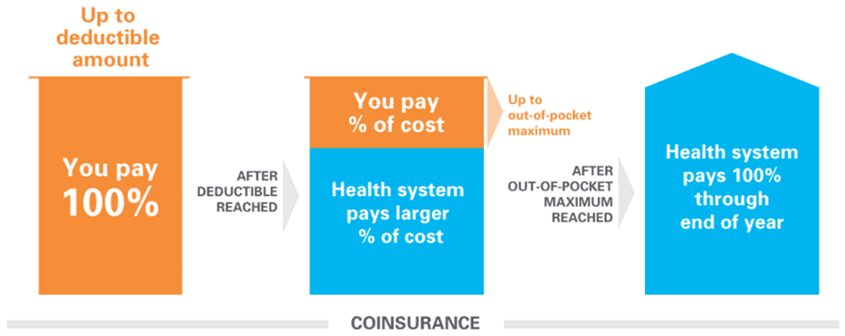

Coinsurance is your share of the cost of a covered healthcare service or prescription after you’ve met your deductible. It’s usually figured as a percentage of the amount allowed to be charged for services.

How it works: You’ve paid $1,800 in healthcare expenses and met your deductible. Now, when you go to the doctor, instead of paying the full cost, you and the health system share the cost. For example, if you are in the HSA Advantage Plan and go to a specialist physician in the health system network after you’ve met your deductible, the health system pays 90%. The 10% you pay is your coinsurance.

A copay is a fixed amount you pay for a covered healthcare service or prescription, usually due when you receive the service. The Signature Plan uses copays for many services; the HSA Advantage Plan uses copays on a limited basis related to prescriptions for chronic conditions.

The copay amount is different depending on the type of service/prescription and which provider network or pharmacy you use. Copays do not count toward your deductible – you always pay that amount whether you have met your deductible or not until you reach your out-of-pocket maximum.

How it works: You are in the Signature Plan and see a health system specialist several times a year. At each visit, you will pay a $40 copay, even if you have met your annual deductible, until your out-of-pocket maximum is reached.

The phrase “meet your deductible” means paying that amount before the health system begins to pay its share of your medical care. After you meet your deductible, your share of cost is coinsurance.

Each medical plan has a different type of deductible.

Both deductibles reset to zero on January 1 each year.