Click here to see information about 2025 benefits

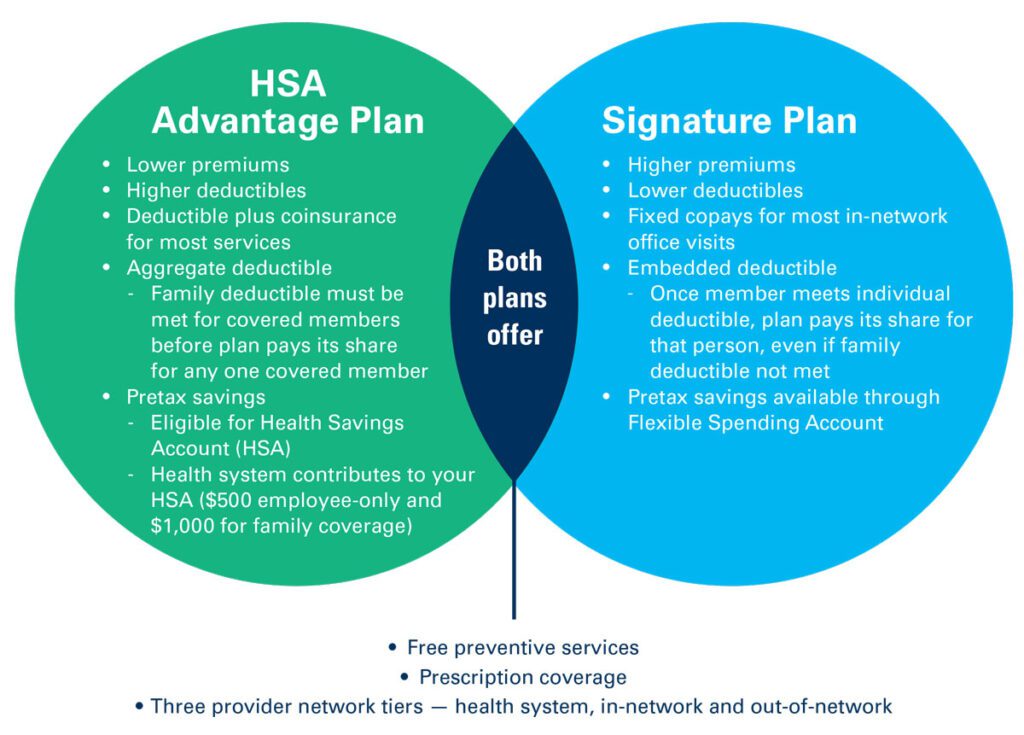

The health system offers a choice between two medical plans for health insurance coverage — the HSA Advantage Plan and the Signature Plan.

A high deductible plan (HSA Advantage) works best if you use less healthcare OR have extensive healthcare needs. These questions can help you decide:

The HSA Advantage Plan works best for those who use less healthcare, OR those who need extensive healthcare. The per-paycheck premiums are lower, but your cost of care during the year is higher through deductibles and coinsurance.

With this plan, you will have a Health Savings Account (HSA), which allows you to save money on a pretax basis to pay for qualified medical expenses for you and your dependents. The health system contributes “seed” money deposited directly into the account.

Employees can contribute additional pretax dollars from each paycheck, up to $4,400 per year for individual coverage; $8,750 for family coverage. Employees age 55 and older may contribute an additional $1,000. Visit pretax savings accounts for more information on HSAs, healthcare flexible spending accounts (FSAs) and child or elder care flexible spending accounts (FSA).

These questions can help you decide whether the HSA Advantage Plan is right for you:

If you answered yes to questions 1, 2 or 3 – and answered yes to questions 4 and 5 – then the HSA Advantage Plan may save you money. To discuss this option with a benefits expert, schedule a one-on-one meeting.

This works best for heavier users of healthcare and those who need predictability for their budget. It offers lower deductibles and fixed copays for in-network office visits but has higher per-paycheck premiums.

This plan uses an embedded deductible. This means that once a covered member meets the individual deductible, the health plan’s coinsurance begins to cover that person’s expenses – even if the full family deductible amount has not been met.

With the Signature Plan plan, you may elect to enroll in a Healthcare Flexible Spending Account (FSA), which allows you to save money on a pretax basis to pay for qualified medical expenses for you and your dependents. Employees can contribute pretax dollars from each paycheck, up to $3,300 per year. Visit pretax savings accounts for more information on Health Flexible Spending Accounts.

Both the HSA Advantage and Signature plans offer you and your family access to the health system network of providers at the most affordable rates. When you need care elsewhere, both plans also offer access to a network of providers around Kansas City, as well as a nationwide network.

Explore Finding a provider for more details, including:

Use the charts below to understand the premium you will pay for medical insurance, including your prescription coverage, plus the larger portion the health system pays to support you. If your spouse is offered medical insurance through their employer, you will pay an extra $50 per paycheck to add them as a covered dependent.

Changes in FTE status that affect employee share of medical premiums will take effect on the first day of the month after the FTE change effective date (this update happens automatically – no action is needed by the employee). This applies to employees who:

Per-Paycheck Premiums* | HSA Advantage Plan | Signature Plan | ||

Employee pays | Health system pays | Employee pays | Health system pays | |

Employee only | $38.00 | $415.81 | $71.00 | $384.00 |

Employee + spouse | $159.00 | $755.08 | $239.00 | $679.60 |

Employee + children | $131.00 | $716.54 | $206.00 | $640.69 |

Employee + family | $217.00 | $1,173.57 | $327.00 | $1,091.66 |

(will align with health system premiums over time)

Per-Paycheck Premiums* | HSA Advantage Plan | Signature Plan | ||

Employee pays | Health system pays | Employee pays | Health system pays | |

Employee only | $38.00 | $415.81 | $71.00 | $384.00 |

Employee + spouse | $144.00 | $770.08 | $239.00 | $679.60 |

Employee + children | $120.00 | $727.54 | $190.00 | $656.69 |

Employee + family | $182.00 | $1,208.57 | $327.00 | $1,091.66 |

Per-Paycheck Premiums* | HSA Advantage Plan | Signature Plan | ||

Employee pays | Health system pays | Employee pays | Health system pays | |

Employee only | $41.00 | $412.81 | $76.00 | $379.00 |

Employee + spouse | $170.00 | $744.08 | $257.00 | $661.60 |

Employee + children | $139.00 | $708.54 | $219.00 | $627.69 |

Employee + family | $232.00 | $1,158.57 | $353.00 | $1,065.66 |

Per-Paycheck Premiums* | HSA Advantage Plan | Signature Plan | ||

Employee pays | Health system pays | Employee pays | Health system pays | |

Employee only | $41.00 | $412.81 | $76.00 | $379.00 |

Employee + spouse | $170.00 | $744.08 | $257.00 | $661.60 |

Employee + children | $139.00 | $708.54 | $219.00 | $627.69 |

Employee + family | $232.00 | $1,158.57 | $353.00 | $1,065.66 |

*Taken from 24 paychecks per year

As you consider which plan is right for you, use the chart below to compare your out-of-pocket costs for different services under each plan.

HSA Advantage Plan Signature Plan Health system network In-network* Out-of-network Health system network In-network* Out-of-network Annual deductible $1,800 individual $3,600 family $4,000 individual $8,000 family $6,400 individual $12,800 family $500 individual $1,000 family $2,000 individual $4,000 family $4,000 individual $8,000 family Annual maximum out-of-pocket costs $4,500 individual $9,000 family $6,000 individual $9,200 family $19,800 individual $39,600 family $4,500 individual $9,000 family $6,000 individual $12,000 family $10,500 individual $21,000 family Member coinsurance You pay 10%; You pay 30%; You pay 40%; You pay 10%; You pay 30%; You pay 40%; At the doctor's office Routine preventive care You pay $0; You pay $0; 40% coinsurance after deductible You pay $0; You pay $0; 40% coinsurance Primary care 10% coinsurance 30% coinsurance after deductible 40% coinsurance after deductible $20 copay $30 copay 40% coinsurance Specialist 10% coinsurance after deductible 30% coinsurance after deductible 40% coinsurance after deductible $40 copay $60 copay 40% coinsurance Urgent care 10% coinsurance 30% coinsurance after deductible 40% coinsurance after deductible $40 copay $60 copay 40% coinsurance At the hospital Emergency 10% coinsurance after deductible 30% coinsurance after deductible 30% coinsurance after deductible** 10% coinsurance after deductible 30% coinsurance after deductible 30% coinsurance after deductible** Inpatient services Outpatient services 10% coinsurance 30% coinsurance after deductible 40% coinsurance after deductible 10% coinsurance 30% coinsurance 40% coinsurance after deductible Other medical benefits Outpatient therapy (speech, hearing, PT, OT) High-tech radiology (MRI, CT, PET scan) 10% coinsurance after deductible 30% coinsurance after deductible 40% coinsurance after deductible 10% coinsurance after deductible 30% coinsurance after deductible 40% coinsurance Mental health & substance use Inpatient services^ 10% coinsurance after deductible 30% coinsurance after deductible 40% coinsurance after deductible 10% coinsurance after deductible 30% coinsurance after deductible 40% coinsurance Outpatient services^^ 10% coinsurance 30% coinsurance after deductible 40% coinsurance after deductible $20 copay for office visits; all other services $30 copay for office visits; 30% coinsurance after deductible for all other services 40% coinsurance after deductible Pharmacy Prescription medication coverage is a big factor in choosing a medical plan. Review the Prescription drug coverage section for important details on prescription drug coverage for each plan. *In-network providers are part of either HCH Sync Centrus local network or Aetna nationwide network (outside the designated local network only). **To ensure access to emergency care, coinsurance for qualified ER visits applied after deductible is met for in-network care. ^ Preauthorization required; coverage of room and board may be denied. ^^Preauthorization required for ABA therapy.

plan pays 90%

plan pays 70%

plan pays 60%

plan pays 90%

plan pays 70%

plan pays 60%

plan pays 100%

plan pays 100%

plan pays 100%

plan pays 100%

after deductible

after deductible

after deductible

after deductible

after deductible

after deductible

Department

after deductible

after deductible

after deductible

after deductible

after deductible

after deductible

100% covered