Understanding the options for medical benefits

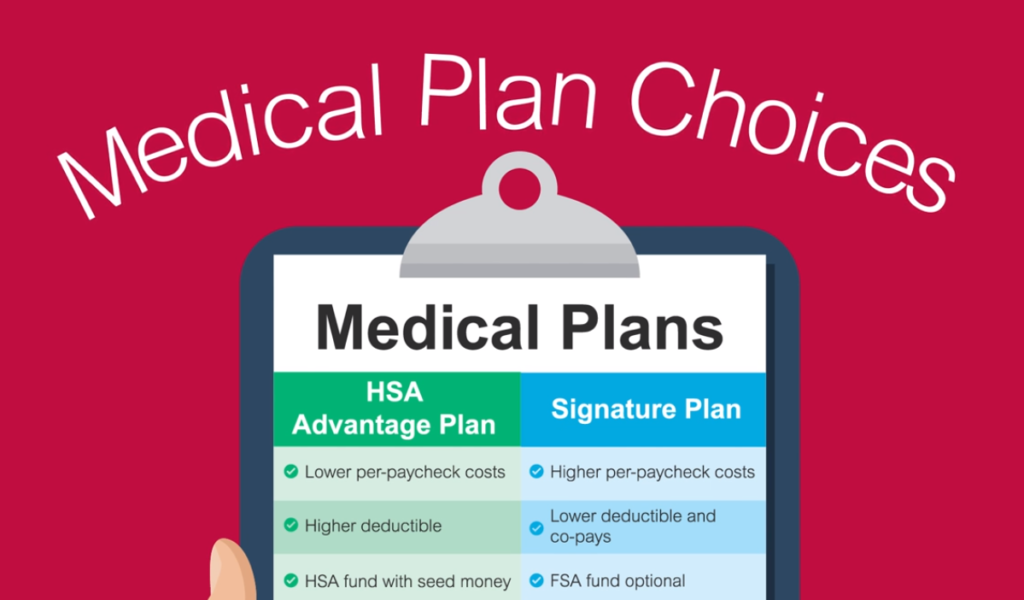

The health system offers the choice of two plans for employees to consider for coverage of medical expenses.

- Signature Plan

- traditional PPO

- higher per-paycheck costs

- lower deductibles for care

- traditional copays for care

- HSA Advantage Plan

- lower per-paycheck costs

- higher deductibles for care

- coinsurance once deductible is met

In-network care

Preventive care is 100% covered in both plans when in-network providers are used. This is to encourage employees and their dependents to get their appropriate check-ups and screenings.

Because we are proud of the care we provide, using a health system provider is the most affordable option in both plans.

The second-lowest cost option is for in-network providers. Both plans use the BlueSelect Plus and Blue Card PPO networks from Blue Cross and Blue Shield. To see if your providers are in-network:

- Visit myhealthtoolkitkc.com

- Click “Find a Provider”

- Enter the alpha prefix “USK” to see in-network providers for the HSA Advantage and Signature plans.

Understanding the HSA Advantage Plan

Employees who choose the HSA Advantage Plan will have a health savings account to help pay for healthcare expenses with pre-tax dollars.

Here are important things to know about electing an HSA:

- The health system provides “seed” money to support employees with healthcare expenses. The money is deposited on January 1, 2022.

- Individual coverage: $500

- Family coverage: $1,000

- Employees may contribute additional pre-tax dollars to their HSA from each paycheck to build up the account for healthcare expenses. Use the online calculator to determine how much to save, up to the maximum amount allowed by the IRS:

- $3,650 for individual coverage

- $7,300 for family coverage

- Employees 55 and older may contribute an additional $1,000

- Think of an HSA as a guaranteed discount on money you’re already going to spend on eligible healthcare expenses (braces, prescription drugs, copays for medical care and much more).

- Using HSA funds is easy with a mobile app, debit card and online account.

- Funds in an HSA roll over from year to year.

- HSA funds are 100% yours and the money goes with you if you leave the health system.

- You can invest the money in your HSA if you have at least $1,000 in your account. Review this information to learn how to invest your HSA dollars.

If you’d like to learn more about how to use an HSA, visit the HSA planner offered by WEX.