Understand your medical plan network to get the care you need plus greater savings

How can you get lower copay, deductible and coinsurance costs while still receiving high quality healthcare? You can by knowing your networks! In this article, we’ll help you understand what medical plan networks are and how you can save on out-of-pocket medical costs by selecting healthcare providers and facilities that are in lower cost networks. (Hint: the health system network is your lowest-cost option!)

What is a medical plan network?

Let’s start by defining what we’re talking about. A network comprises the providers and facilities a health insurance company contracts with to provide healthcare services to its members at a discounted cost. That discounted cost is passed to members, who also benefit from lower copay, deductible and coinsurance costs – plus a lower annual out-of-pocket maximum. The opposite is true for out-of-network – no discount and higher out-of-pocket costs. Bottom line: It pays to have a provider in your medical plan’s preferred networks!

The health system offers three networks for both health plans – the HSA Advantage Plan and the Signature Plan:

- Health system network

- In-network (BlueSelect Plus in KC; BlueCard PPO outside KC)

- Out-of-network

Keep reading to learn about each network and how to check which network your healthcare provider is in or how to find a new one.

In-network

Flexibility and choice are important, so our medical plan includes an in-network option that still helps you save money. You may be wondering how in-network is different from the health system network. These are providers and facilities outside of our health system that have agreed to accept an approved amount for their services from the health insurance company.

So, if an in-network doctor charges $150 for a service and the approved amount with the medical plan is $90 – you save $60. You’ll also pay a lower annual deductible, coinsurance and copays compared to using out-of-network care. Your out-of-pocket maximum is also significantly lower compared to using out-of-network care.

Both medical plans offer access to a variety of in-network providers and facilities for covered services through the Blue Cross Blue Shield network.

- Kansas City metro area: Through the Blue Select Plus network, both medical plans give you access to more than 4,100 providers at facilities including:

- Advent Health (3 locations)

- Cameron Regional Medical Center

- Children’s Mercy (Hospital Hill and South)

- Liberty Hospital

- North Kansas City Hospital

- St. Joseph Medical Center

- St. Mary’s Medical Center

- Providence Medical Center

- University Health (Truman and Lakewood)

- Western Missouri Medical Center

- Greater Kansas and nationwide: Both medical plans offer in-network coverage via the BlueCard PPO network in greater Kansas and nationwide (excluding a designated 20-county area in Missouri, east of Kansas City designated in the light blue on the map).

While not as low-cost as the health system network, you’ll still save compared to out-of-network care.

Out-of-network

Simply put, it’s the opposite of in-network. Out-of-network healthcare providers and facilities (such as HCA and Saint Luke’s) have not agreed to accept an approved amount for services from the health insurance company. So, you pay more for getting care because the rates are likely higher than the discounted health system and in-network rates. You’ll also pay significantly more toward your deductible, copays, coinsurance and out-of-pocket maximum. Plus, any money you spend on health system and in-network care does not count toward the out-of-network out-of-pocket deductible or out-of-pocket maximum – making it even more costly. One caveat: Insurance plans can’t make you pay more in copayments or coinsurance if you get emergency care from an out-of-network hospital.

Given the big impact on your bottom line, it’s important to make sure your provider is in-network – or better yet – in the health system network for the absolute lowest cost to you.

Find a provider

Find a health system or in-network provider or check which network your provider is in by using Blue Cross Blue Shield’s find a doctor tool. Here’s how:

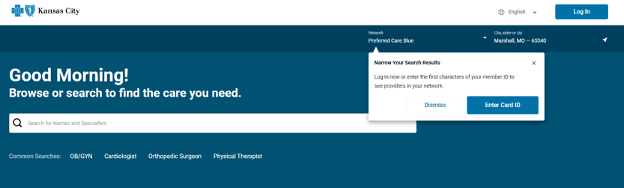

1. Click on the “Enter Card ID” button in the pop-up (you do not need your credentials)

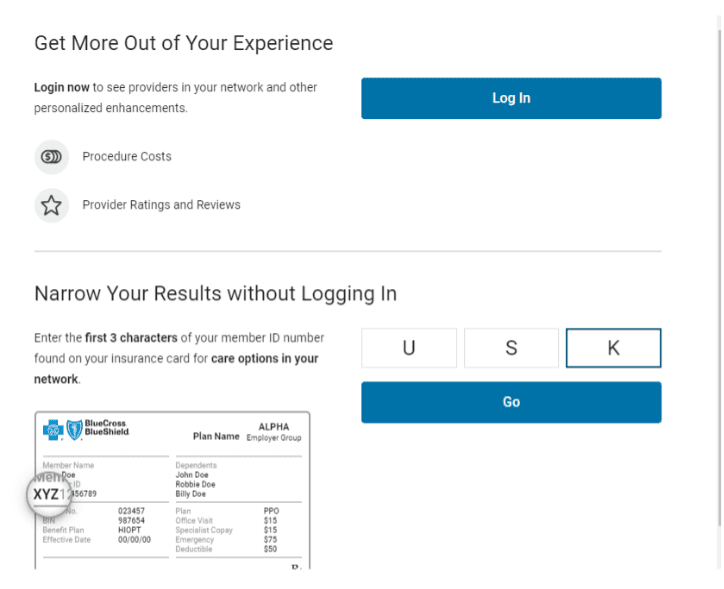

2. Narrow your results without logging in by entering “USK”

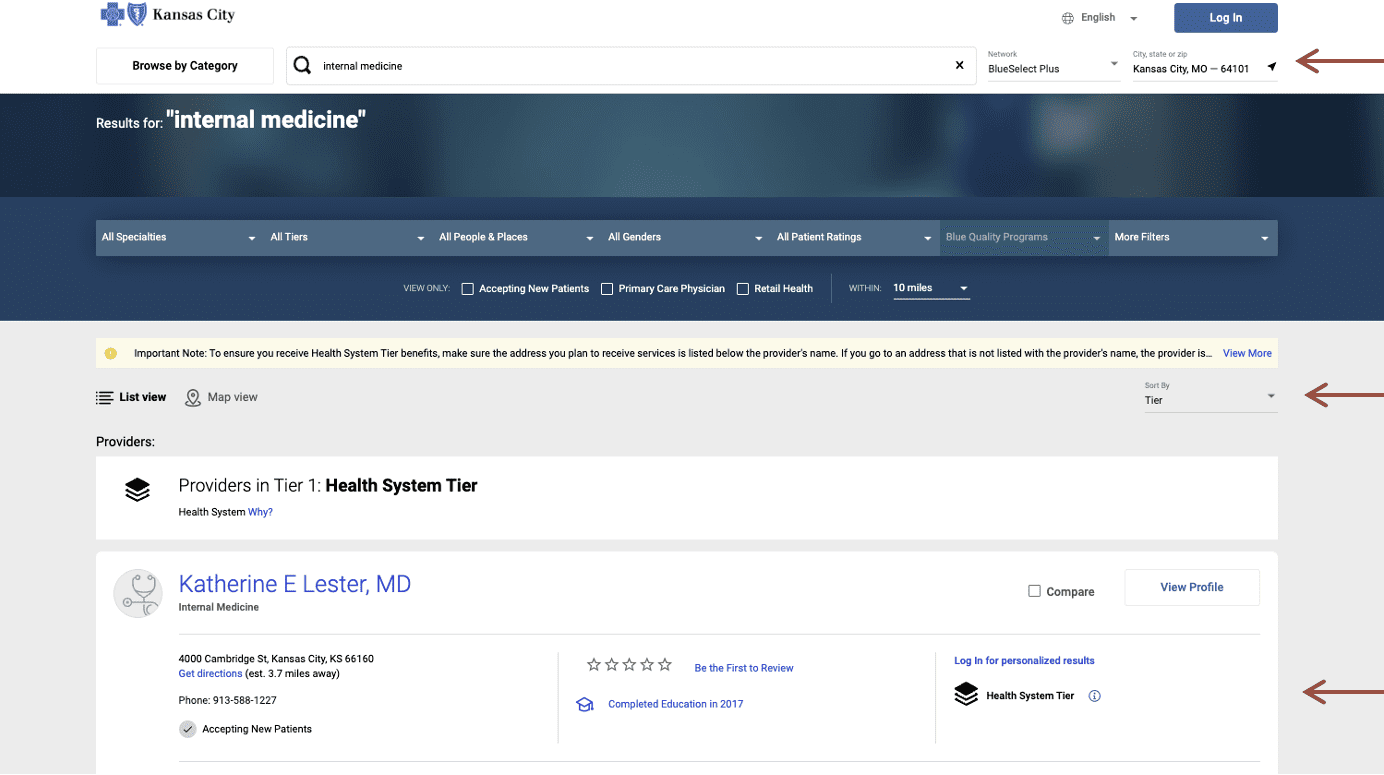

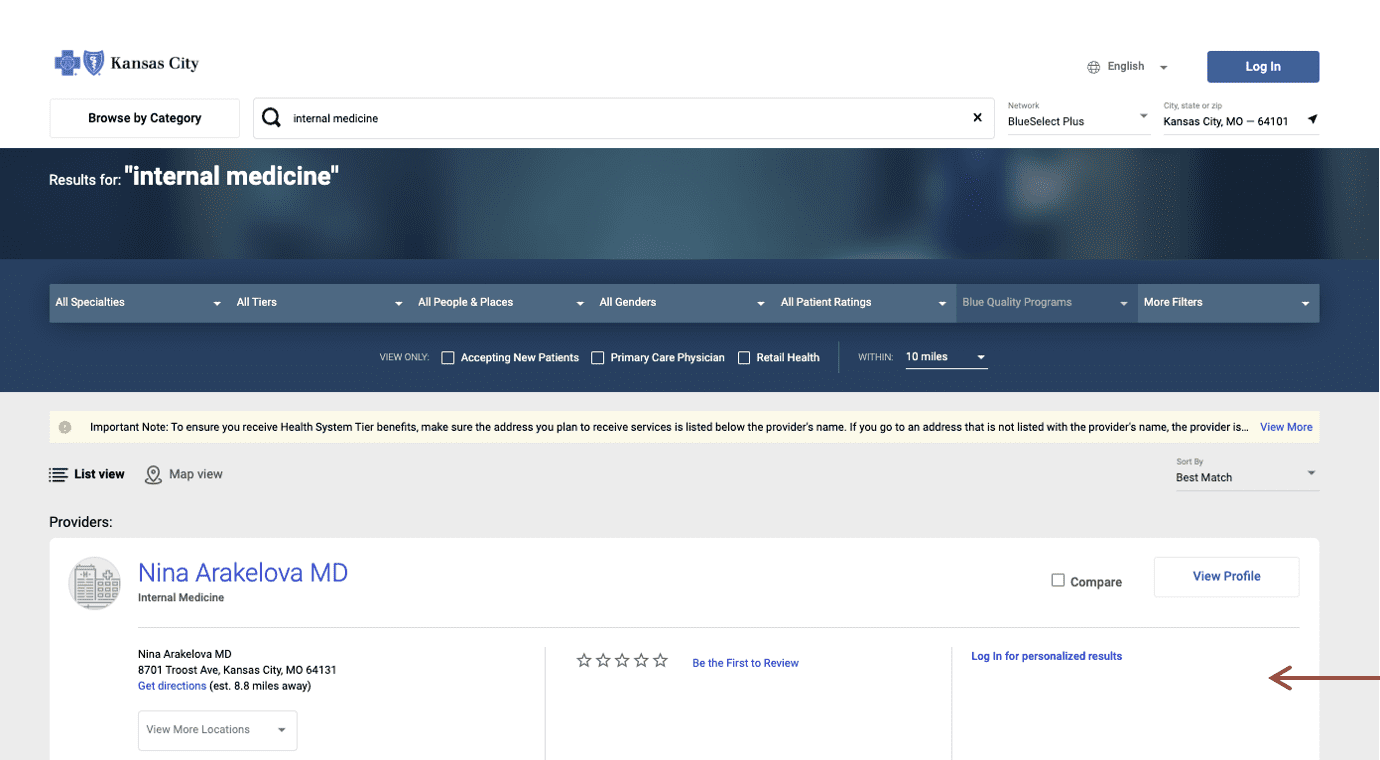

3. The providers will be sorted by “tier” and health system tier providers will be listed first. In the upper right corner, select the network and zip code for your search.

All other providers listed that do not say “health system tier” in the right column are in-network providers. Out-of-network providers will not appear in the list.

Deductibles, coinsurance and copays with the medical plan network

This chart shows how the network for each plan impacts your out-of-pocket costs, including deductibles (ded), coinsurance (coins) and copays for different services. Preventive care is free in both plans. For more information about how you and the health system share the cost for your healthcare expenses on either plan, read Understanding deductibles, copays and coinsurance.

HSA Advantage Plan | Signature Plan | |||||

Single | $1,500 | $3,000 | $6,000 | $400 | $1,500 | $2,000 |

Family | $3,000 | $6,000 | $12,000 | $800 | $3,000 | $4,000 |

Out-of-Pocket Maximum | ||||||

Single | $4,000 | $4,000 | $19,800 | $4,000 | $4,000 | $10,500 |

Family | $8,000 | $8,000 | $39,600 | $8,000 | $8,000 | $21,000 |

Member coinsurance | 10% | 30% | 40% | 10% | 30% | 40% |

Office Visit | ||||||

Primary care (in-office or virtual visit) | Ded+10% coins | Ded+30% coins | Ded+40% coins | $20 copay | $30 copay | Ded+40% coins |

Specialist (in-office or virtual visit) | Ded+10% coins | Ded+30% coins | $40 copay | $60 copay | ||

Routine preventive care | Covered at 100% | Covered at 100% | Covered at 100% | Covered at 100% | ||

Outpatient therapy (speech, hearing, physical, occupational) | Ded+10% coins | Ded+30% coins | $40 copay | Ded+30% coins | ||

Urgent care | Ded+10% coins | Ded+30% coins | $40 copay | $60 copay | ||

Inpatient/Outpatient Services | ||||||

Emergency Department | Ded+10% coins | Ded+30% coins | Ded+30% coins* | Ded+10% coins | Ded+30% coins* | Ded+30% coins* |

Inpatient hospital services | Ded+40% coins | Ded+40% coins | ||||

Outpatient hospital services | ||||||

High-tech radiology services (MRI, CT, PET scan) | ||||||

*To ensure access to emergency care, coinsurance will be applied after the member meets the deductible for in-network care.